Italian manufacturers: all indicators good for the first half year, turnover and orders are growing

A positive trend for plastics and rubber processing machinery in the first half of 2021 announced by the trade association Amaplast: the latest mid-year survey conducted by the Mecs Statistical Study Center records double-digit growth in both turnover and orders, consolidating the cli-mate of renewed faith in the sector after the long and difficult period of the pandemic. With respect to January-June 2020, turnover has increased by +11%. Domestic machines sales have remained high while demand abroad principally regards replacement parts.

Companies have also witnessed a clear improvement in their order books in the first six months of 2021, recording +46% with respect to the previous year. The recovery is mainly driven by the major commissions for plants by Italian customers (with an impressive +134% in the last quarter alone) but there is also a very positive trend in orders from abroad, both for machinery and for replacement parts (+58%). Given this trend an average of 6.4 months of production are already assured.

The rebound in the domestic market thus confirms a greater propensity for investment by Italian companies, partially thanks to incentives (tax credits for modernizing systems and investing in Industry 4.0) provided by industrial policy plans.

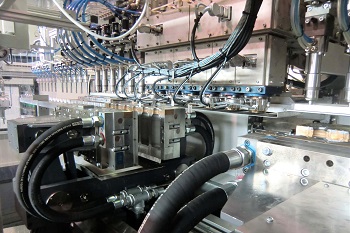

All four major sectors for plastics and rubber processing machines continue to show lively performance. Medical, packaging, and automotive in particular show signs of growth that should be confirmed in the coming months while the construction industry has stabilized.

Uncertainties still remain regarding the spread of the Delta variant and concern is still high about high raw materials prices and their relative scarcity, factors which lengthen average delivery times and compress margins.

Uncertainties still remain regarding the spread of the Delta variant and concern is still high about high raw materials prices and their relative scarcity, factors which lengthen average delivery times and compress margins.

Also contributing to tensions is the unabated rise in sea freight rates, which have reached record levels. Logistic difficulties and increasing shipping prices are seen in all geographical areas and the trend may continue through the summer, since demand generally increases in this season.

The Mecs Study Center has completed its National Statistical Survey, conducted for the first time in organic form among Italian manufacturers of plastics and rubber processing machinery, equipment, and moulds.

The general picture is of a sector that produced revenues of 3.74 billion euros in 2020, with nearly 76% of the total from exports, confirming the historical emphasis on exports by companies in the industry. The nearly 350 companies surveyed, employing just over 13,000 people, are mainly concentrated in Lombardy (55%), Emilia-Romagna (15%), and Veneto (13%). Most of them are small companies: 74% bring in less than 10 million euros in revenues, with an aggregate value that does not reach a quarter of the total and less emphasis on exports. In parallel, large companies, while only representing 26% of the total by number, generate 77% of the turnover and reach export quotas above 85%.

The greater level of detail in the survey with respect to its predecessors also makes it possible to identify the shares of production by application and technology.

The first indicator shows that packaging is the main outlet market for Italian manufacturers, and more specifically food packaging (30% of turnover), followed by other packaging segments (ap-proximately 12%); automotive absorbs 19% of production, and construction 11%; medical, agriculture, electronics/electrotechnics, and other applications following in decreasing order with shares ranging from 4% to 2%.

The first indicator shows that packaging is the main outlet market for Italian manufacturers, and more specifically food packaging (30% of turnover), followed by other packaging segments (ap-proximately 12%); automotive absorbs 19% of production, and construction 11%; medical, agriculture, electronics/electrotechnics, and other applications following in decreasing order with shares ranging from 4% to 2%.

As for machinery types, we observe that the category of the extruders, with 17% of the total, rep-resents the largest core of turnover for the sector; they are followed by auxiliaries at 12%, injection moulding machines at 11%, and blow-moulding machines at nearly 7%. Recovery and recycling lines and the macro-category of rubber processing machines each approach a share of 6%.